Women and Long Term Care

-

Women take care of men. But who takes care of the women?

Women take care of men. But who takes care of the women?

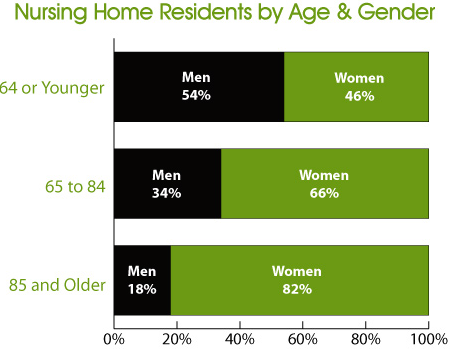

Know that 72% of women over 65 will need long term care and that women make up the majority of residents in long term care facilities.

-

Wouldn't you rather plan where you would receive quality care, your family is not burdened, and your savings and assets are protected? This is what a long term care insurance policy from us will provide.

We only work with the top companies that have the best financial and consumer ratings. It's no surprise that most of our clients are women -- know the risk, they want protection, they like to plan. It's better to consider long term care protection a year too early than a day too late!

We often hear "I should have bought this sooner when I was younger and it was cheaper." It will never be cheaper to insure than it is today, and if you wait you may not pass health underwriting.

Insurance helps people stay in their home because they have more money for care.

-

Do you think your are going to live a long life?

If so, do you think that as you age you may become frail or have difficulty doing the things you can easily do now such as bathing or dressing? If so, what is your plan?

Financial planners agree that it is essential to have a long term care plan.

Today, you have three choices:

1) pay for care yourself,

2) go on state aid (Medicaid welfare health care),

3) long term care insurance.If you do not buy insurance to protect yourself which of the other two are you going to plan for? Pay yourself or state assistance (Medicaid)?

If you decide to pay yourself how long will your savings last if care costs $80,000+ a year?

After your savings is gone you are left with only one option, state welfare health care (Medicaid).

How will you pay for care?

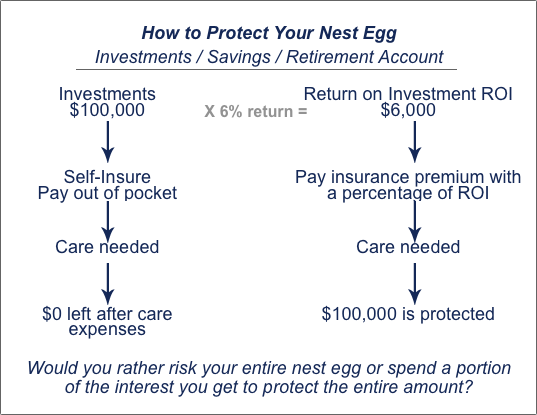

If you self-insure, you will end up using your savings/investments to pay for your long term care. First you'll use the income from your savings/investments and then the principal. Once that is spent the next source of money will be your assets.

Is your plan to spend your savings and assets on long term care or do something else with them?

-

How much is insurance and can I afford it?

People buy long term care insurance so they won't be a burden, they want access to quality care and the ability to stay in their homes. But how to pay for it?

If you needed care you'd be spending as much as $6,000¹ a month out of savings, but long-term care insurance shouldn't be a financial hardship. A comprehensive policy price is based on the benefits you choose and your age and can range from $100 to $500 per month. A few of our clients purchase high benefit plans, others get low benefit plans, but most get benefits in the middle.

First get a quote and find out what it will cost you. Then if the quote is in your budget the next step is to see if you qualify, there is no obligation to see if you qualify.

I can't afford long term care insurance.

If you don't have much in savings or income or if your family can't help, you are on the road to Medicaid.

If you should need care that can be done at home, consider areverse mortgage. A reverse mortgage is not a substitute for long term care insurance. A reverse mortgage may allow you to stay longer in your home.

Once you need a higher level of care and can't stay at home then you may require Medicaid. Feel free to contact us if you have any questions.

Are you a planner or a gambler?

Do you know enough yet to make a plan for your long term care? If not feel free to explore other parts of our website or contact us with any questions.

If you think that by waiting to decide to insure you are not deciding,

you just decided.

More than 30% of strokes occur in women before the age of 65.

-

Help When You Need It

One of most important benefits with long term care insurance is not how much money you get but the person-to-person support when you need it. This is especially important if you are single or if your spouse cannot care for you. (all companies offer similar services, often using the same service providers)

DOWNLOAD THESE BROCHURES

Women As Receipents of Care and Providers of Care

Women in Your Life "Stroke" Booklet

¹ Median cost of care in the US is $85,000 a year based on a 2017 Cost of Care survey, it may be more or less where you live.

² Premiums can average $100-$1000 per month depending on age and benefits - get a quote and find out how much your premium would cost.

Get started, get a quote.